What is CRM in Payment Processing? – How To Proceed

How to Accept Payment in your CRM Software?

When we talk about the primary aspects of your business, CRM tops the list when it comes to managing a relationship with customers and boosting business.

It is worth noting that CRM makes storing every interaction made with a customer, campaign management, sales automation, and customer segmentation a piece of cake. What comes as a fascinating fact is that CRM also unlocks your world to seamless sales and subscription billing.

Closing the deals much faster and collaborating with a large array of customers while keeping a check on vast invoicing and billing is more than easy now.

Today you can accept a wide range of payment types, minimize your losses to scams, attain valuable business insights as well as get paid faster. CRM Software can be equipped with billing support without any hassle.

You can easily process each and every kind of debit & credit card payment and that too without any additional cost. One can even leverage premium features such as deferred and recurring payments, respectively.

Handling payments from your CRM software enable you to take charge of your subscription scenarios as well as pricing models.

Thus, it doesn’t matter if you’re a small business or a large enterprise, you can manage your sales pipeline, effectively.

Benefits of accepting payments on CRM:

- Faster Deposits

- Multi-Currency Billing

- Recurring Payments

- Sales Scalability

- Eliminate Security Risks

- Multi-Language Receipts

- Automatic Tax Calculations

- Automatic Report and Summary Generation

Why take up payments on CRM Software?

When it comes to taking payments from your CRM software, it’s pretty simple. You can achieve the same in a few clicks via PayPal or Stripe. Payment gateway extension supports can be developed in accordance with your CRM.

Thus, popular payment methods can easily be integrated with your company’s very own CRM.

Integration of payment technology in the deployed CRM can enable you to take up debit card as well as credit card payments directly from the customer’s management interface.

One can even get access to the exclusive option to accept payment on the phone. You can even generate links for your customers to a secure web portal.

As soon as a customer makes the payment, the customer record can be updated in a blink of an eye. Thus, this allows your company to stay up-to-date with the customer’s account, especially the payment information.

When you accept payments on CRM, not only you save valuable time for your staff, but you also boost the efficiency of your business manifolds. Thus, you’d end up entering the data into a single source which is a win-win for everybody.

This would also benefit your organization in terms of data consolidation as well as accuracy. Accessing payments and all customer data from one source increases reliability, hence, reduces the number of systems used.

Accepting payments is usually a three-step process:

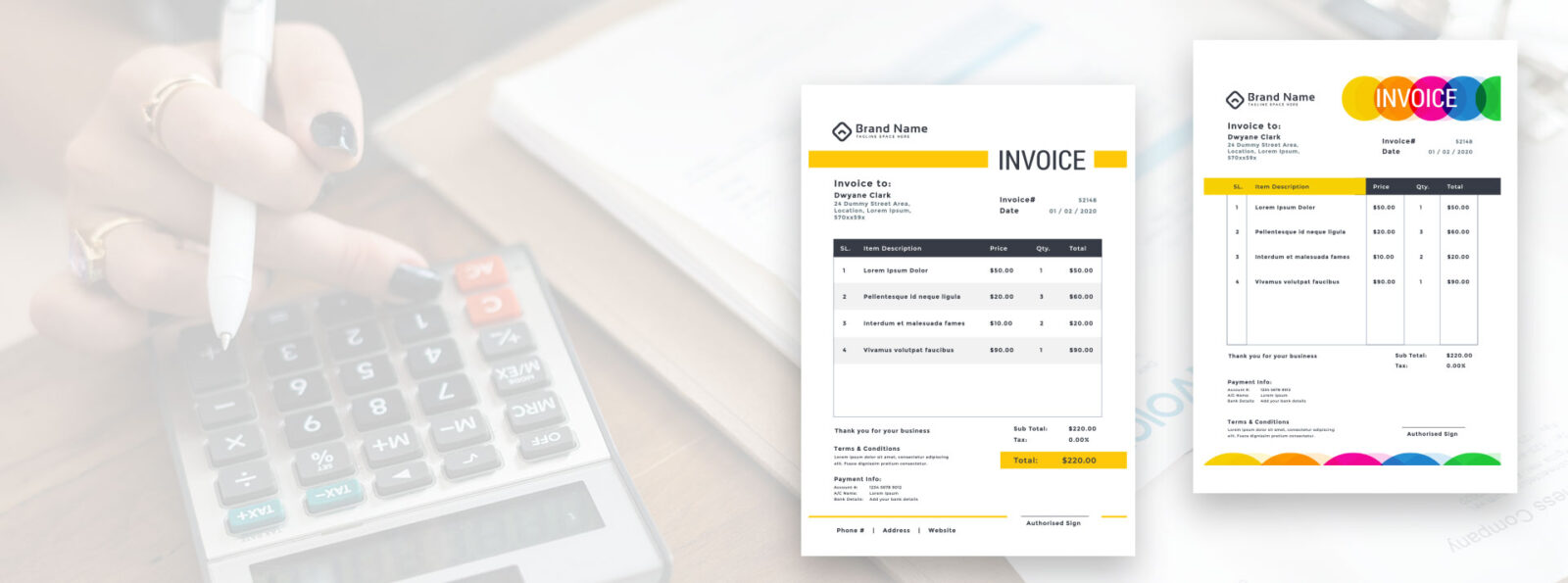

Invoice:

Easily generate invoices and quotes for your customers. One should understand that when you integrate invoicing with the CRM, you can efficiently and neatly organize invoices, payment histories, and quotes with your contact info, respectively. Also, the best thing is that you won’t have to create invoices again & again from scratch. You can use invoicing templates that suit your business the best.

Process:

Once the invoice has been sent, your customers can easily be referred to a customer payment portal or a specialized secured link can be sent to them. Accepting payments has become a lot easier, customers can pay through their credit card and other online merchants such as PayPal, Skrill, etc.

Get Paid:

The payments from your clients are processed right into the CRM. No more searching through the stacks of paper. Each and every payment type is neatly managed and organized. Payment records are kept in a searchable group fashion.

Do you have to void a transaction or refund the amount? No worries, it can be done just right.

What would be better if you could sync bits and pieces of customer data such as subscriptions, memberships, pricing, coupons, etc. under the same hood?

One can even leverage multi-currency support, thus making the onboarding process easy for users around the world. Integrating payment support with existing CRM can reduce AP workload. Your business can get paid 3x faster by accepting ACH payments and cards from customers around the world in real-time.

In a nutshell, it can be said that both, billing and invoicing might not be the hippest part of your business, though managing them efficiently can lead to better customer retention.

Also, when it comes to SMBs, accepting payments on CRM or integrate payment gateways with CRM software can lead to sustainable business growth. SaaS companies around the world that are offering monthly subscriptions can benefit the most.

For the purpose of attaining the ultimate return on investment (ROI), you can automate sales campaigns around payment-related tags as well.